Through the Lens of the CEO: Hims & Hers Health Inc. — When your Biggest Win becomes your Biggest Risk

A First Look At The Business: Hims & Hers Health Inc.

Hi, everyone!

I'm Felix, and today I'm stepping into Andrew Dudum's shoes, the CEO who turned a men's hair loss company into a $2+ billion healthcare disruptor, only to find himself in the crosshairs of Big Pharma's most aggressive counterattack. When Novo Nordisk terminated our partnership in June 2025, they thought they were cutting off our oxygen supply. Instead, they just proved how much we'd already changed the game.

Overview

Today, I’ll discuss the following things through the eyes of Andrew Dudum:

Products

Market Position

Revenue Model

Legal Challenges

Novo Nordisk Allegations

Growth Strategy

Introduction

Last month, when Novo Nordisk terminated our partnership over "deceptive marketing" claims, most analysts saw vindication of their skepticism. I see the cost of disrupting a $200 billion pharmaceutical oligopoly.

Wall Street still doesn't grasp, that we’ve built a $225 million GLP-1 revenue stream in 2024 by offering compounded semaglutide at $199/month when branded Wegovy costs $1,300+. After that, the FDA declared the shortage over in February 2025, legally ending our ability to sell compounded versions. Our partnership with Novo was supposed to be the solution, letting us sell branded Wegovy through our platform. Instead, they terminated it in June, claiming we were still promoting "illegitimate knockoff versions."

Now we're facing class action lawsuits with an August 25, 2025 deadline, alleging we misled investors about the sustainability of our GLP-1 business model. Our stock has been hammered, but here's what the litigation noise misses: We’re not a one trick GLP-1 story. We’re a scalable healthcare platform with proven execution.

Q1 2025 revenue hit $586 million, up 111% year-over-year, with 2.4 million subscribers. Even without compounded GLP-1s, we have three specialties on track to deliver $100+ million each in 2025. The question isn't whether we can replace GLP-1 revenue. It's whether we can do it fast enough to justify our current valuation while legal costs mount.

Understanding our pivot strategy and the lawsuit overhang sets up the critical investment question: Are we a wounded growth story or a resilient platform company? I'll answer that in this week's "Fundamentals Meet Technicals" analysis, where I'll break down whether our current valuation reflects temporary headwinds or permanent impairment.

Make sure to SUBSCRIBE, so you don’t miss out on any ‘Fundamentals meet Technicals’ articles in the future!

Our Products: The product strategy & post-GLP-1 reality

While competitors like Roman and Lemonaid Health remain focused on traditional men's health, we proved we could dominate any category we entered. GLP-1s weren't just revenue, they were proof of concept for rapid market penetration across stigmatized health conditions.

The strategic pivot involves three core areas: mental health, dermatology, and sexual wellness. Each represents a $100+ million revenue opportunity, but the unit economics differ significantly from our GLP-1 goldmine. Compounded semaglutide had massive margins because we bypassed traditional pharmaceutical pricing. These other categories require different competitive strategies.

Here's what typical analysis misses: Our GLP-1 success wasn't just about pricing, it was about solving the access problem. Traditional weight management requires monthly doctor visits, insurance approvals, and pharmacy coordination. We eliminated all friction points. That same model applies to conditions like hair loss, erectile dysfunction, and anxiety treatment.

The risk isn't that we can't grow other categories; it's that none have GLP-1's combination of massive market demand and pricing arbitrage. Mental health medications are generics with thin margins. Dermatology treatments face insurance coverage challenges. Sexual wellness has limited repeat purchase frequency compared to daily medications.

But our competitive advantage remains intact: We've built the infrastructure to launch new treatment categories faster than any competitor. While Roman takes years to expand beyond men's health, we've proven we can scale from zero to $225 million in a single category within 18 months.

Our Market Position: The opportunity & competitive differentiation

The $350 billion U.S. telehealth market opportunity remains massive, but our addressable market just shrunk significantly. GLP-1s represented our largest single category, and replacing that revenue requires diversification across multiple smaller opportunities.

Strategic market analysis reveals our next battlegrounds: Mental health prescriptions grew 38% in 2024, dermatology consultations increased 45%, and sexual wellness treatments expanded 28%. Each represents substantial opportunity, but none matches the explosive growth trajectory we achieved with weight management.

The competitive chess match gets complex when you examine category-specific threats. In mental health, we're competing against BetterHelp, Cerebral, and traditional therapy providers. In dermatology, Curology and Apostrophe have established market positions. Sexual wellness remains fragmented, giving us the best expansion opportunity.

Here's the strategic difference: While category-specific competitors optimize for single conditions, we're building a comprehensive health platform. When patients come to us for one condition, we can address related issues within the same ecosystem. That cross-selling capability becomes more valuable as our subscriber base matures.

The litigation risk creates competitive opportunity. Smaller telehealth companies lack the legal resources to defend against patent challenges or regulatory scrutiny. Market consolidation benefits platforms with strong balance sheets and diversified revenue streams.

Customer acquisition costs remain our competitive advantage. Brand recognition from controversial but effective marketing generates organic searches that competitors can't match through paid advertising alone. Our customer lifetime value exceeds acquisition costs across all categories, not just GLP-1s.

Our Revenue Model: The engine & financial resilience

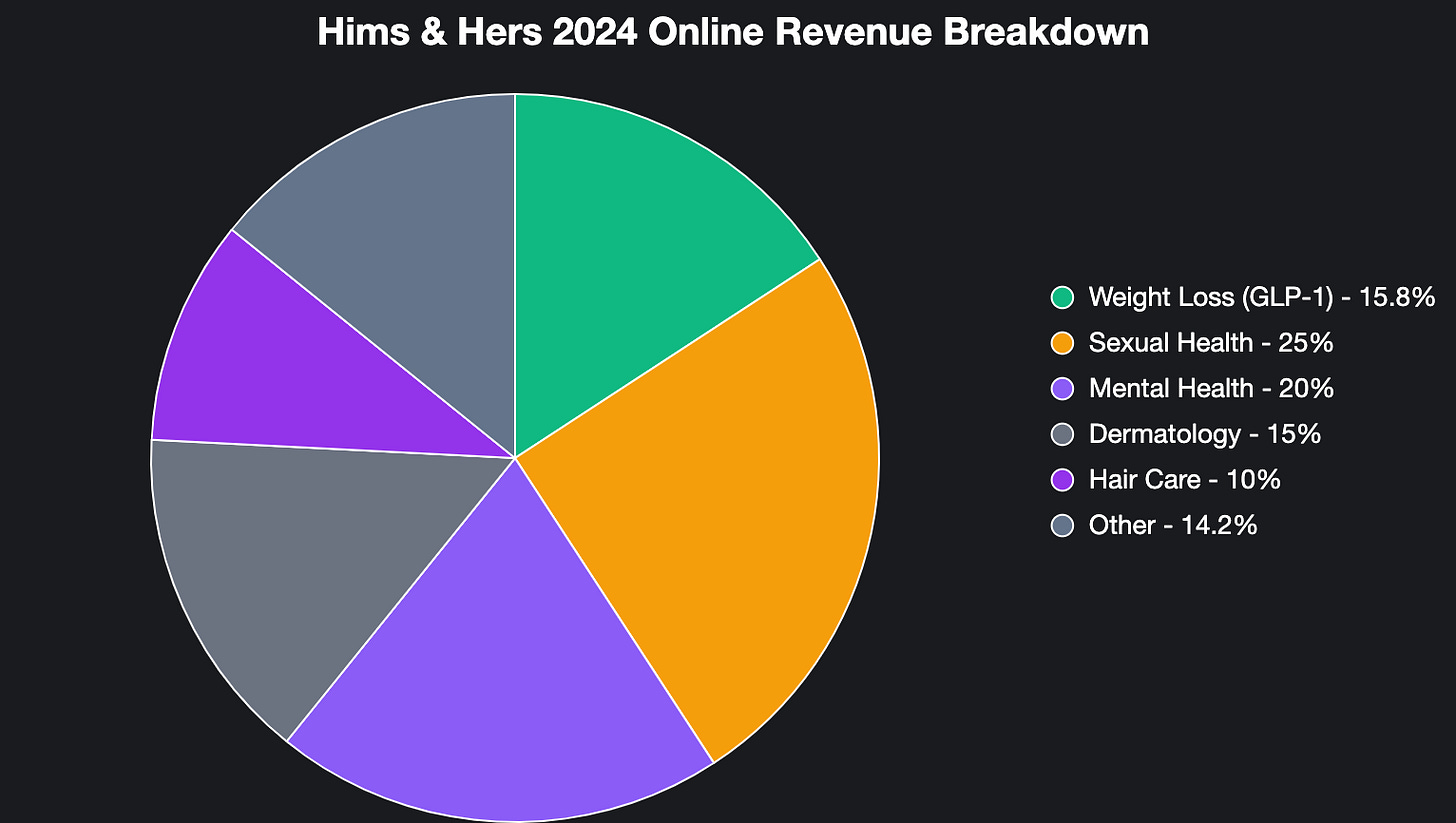

Let's address the elephant in the room: GLP-1 revenue represented a significant portion of our $1.5 billion in 2024 revenue. The $200+ million from compounded semaglutide and other GLP-1 drugs created a hole that requires aggressive diversification to fill.

Q1 2025 financial performance shows resilience despite the regulatory headwinds: $586 million in revenue, up 111% year-over-year, with adjusted EBITDA of $91.1 million. We're not just growing; we're maintaining profitability while absorbing legal costs and restructuring expenses.

The unit economics reality: GLP-1s had exceptional margins because compounded versions cost significantly less than branded alternatives while maintaining premium pricing. Our other categories operate on traditional pharmaceutical margins, requiring higher volume to achieve similar profitability.

Revenue diversification strategy focuses on three pillars. First, accelerating growth in existing categories through increased marketing spend. Second, launching new treatment areas quarterly rather than annually. Third, expanding our subscription model to include wellness products and supplements with recurring revenue potential.

Cash flow from operations remains strong at $91.1 million in Q1 2025, providing the resources to fight legal challenges while investing in growth. Our debt-to-equity ratio stays manageable, but extended litigation could strain financial flexibility.

The 2025 revenue guidance reflects post GLP-1 reality: Growth will come from diversification rather than single category dominance. That's a more challenging but potentially more defensible business model long-term.

Our Legal Challenges: The strategic vulnerabilities

The class action lawsuits represent our most immediate strategic threat. Allegations focus on whether we misled investors about the sustainability of our GLP-1 business model and the regulatory risks surrounding compounded medications.

Legal vulnerability stems from the gap between our public optimism about regulatory compliance and the reality of operating in a legal gray area. The lawsuits claim we continued promoting "illegitimate knockoff versions" even after establishing our Novo partnership, creating the conditions for its termination.

The financial impact extends beyond potential settlement costs. Legal uncertainty creates customer acquisition challenges, partnership negotiation difficulties, and employee retention risks. Each quarter of unresolved litigation reduces our strategic flexibility.

Defensive strategy involves three components. First, aggressive legal defense to minimize settlement exposure. Second, enhanced regulatory compliance processes to prevent future violations. Third, diversified revenue streams that reduce dependence on any single category or partnership.

The Novo situation highlights our platform risk. When pharmaceutical companies control access to branded medications, they can terminate partnerships that threaten their traditional distribution models. Our success at disrupting healthcare pricing made us a target for industry retaliation.

Comparative analysis with competitors shows our unique vulnerability: Roman and other telehealth companies never achieved our scale in regulated categories, avoiding the regulatory scrutiny that comes with market disruption. Our success created the conditions for our current challenges.

Our Perspective on the Allegations: The Novo Nordisk breakup and our GLP-1 strategy

Let me be direct about where we stand with GLP-1 products after Novo Nordisk terminated our partnership on June 23, 2025. This isn't the setback Wall Street thinks it is. It's validation that we disrupted their pricing model so effectively that they had to shut us down to protect their margins.

Can we still sell GLP-1 products?

Absolutely. We're not backing down from the weight management market that generated more then $200 million for us in 2024. Here's exactly how we're doing it:

The Novo partnership was our attempt to play by Big Pharma's rules. That partnership was growing rapidly because patients finally had affordable access to the real thing.

But here's what Novo didn't expect: Even after they terminated us, we had backup plans. We're still selling compounded semaglutide through our 503A pharmacy partnerships in Arizona and Ohio at $165/month. We're also introducing generic liraglutide and planning oral GLP-1 options for 2025. We didn't put all our eggs in the Novo basket because we knew they'd eventually try to shut us down.

Why they really ended the partnership

Novo's official reason was "illegal mass compounding" and "deceptive marketing." Their real reason? We were cannibalising their $1,300/month Wegovy sales with our $599/month offering. When they saw our growth trajectory, they realised we were becoming a threat to their pricing power across the entire obesity market.

They claimed our compounded semaglutide was dangerous because the FDA ended the shortage in April 2025. But here's the reality: That shortage declaration was political theater. Patients still can't afford $1,300/month for Wegovy. We're serving the 90% of people who need these medications but can't access them through traditional channels.

Their "safety" concerns are corporate speak for "profit protection." We follow every FDA regulation for personalised compounding under Section 503A. Every prescription requires a doctor consultation through our platform. We're not mass-producing knockoffs, we're creating personalised treatments for patients who can't use or afford branded alternatives.

Our current GLP-1 strategy

We're operating under Section 503A of federal law, which allows compounding pharmacies to create customised medications when a doctor determines it's medically necessary for a specific patient. This isn't a loophole, it's legitimate healthcare delivery.

Our Arizona and Ohio pharmacy partners compound semaglutide for patients who complete consultations with our licensed physicians. At $165/month, we're still 87% cheaper than branded Wegovy while maintaining clinical oversight and safety protocols.

But compounded semaglutide is just one piece of our strategy. We're diversifying with generic liraglutide, which doesn't face the same regulatory scrutiny. We're also developing oral GLP-1 options for 2025 that bypass injection concerns entirely.

The key insight: We're not trying to replace Novo's entire product line. We're serving the massive underserved market they ignore. When 73% of Americans are overweight or obese but only 2% can afford $1,300/month for treatment, there's a massive opportunity for affordable alternatives.

The real risks we're managing

Let's be honest about the challenges. Novo isn't just complaining, they're preparing legal action. They're claiming our compounded ingredients come from unreliable foreign sources and that we're operating outside FDA guidelines. That's predictable Big Pharma playbook material.

The FDA could increase enforcement pressure. The May 2025 deadline to stop compounding theoretically passed, but enforcement remains inconsistent. Some states are pushing back, and several compounding pharmacies are fighting in court to maintain their rights.

Financial impact is real but manageable. Analysts estimate losing the Novo partnership could reduce our revenue by 7% in the near term, hitting around $543-$550 million. Our stock took a hit on that news, but the market is overreacting to short-term turbulence.

Patient trust represents our biggest risk. Some customers might prefer branded Wegovy despite the cost difference. But our data shows that patients who see results with our compounded version become loyal advocates. Clinical outcomes matter more than brand recognition in weight management.

Why this actually strengthens our position

The Novo breakup forces us to build a more defensible business model. Relying on Big Pharma partnerships was always a temporary strategy. Now we're creating multiple GLP-1 pathways that no single company can shut down.

We're also proving our value proposition. When patients can access effective treatment for $165/month instead of $1,300/month, they don't care about brand names. They care about results and affordability. That's a competitive advantage Novo can't replicate without destroying their entire pricing structure.

The regulatory pressure actually validates our market position. If we weren't effective at disrupting their oligopoly, they wouldn't be fighting so hard to shut us down. Every lawsuit and regulatory complaint proves we're winning the competition for patient access.

The path forward

We're not retreating from GLP-1s, we're expanding our approach. Compounded semaglutide, generic liraglutide, and oral alternatives give us multiple revenue streams that Big Pharma can't control simultaneously.

The next quarterly earnings on the 4th of August will show the real impact, but I'm confident we'll demonstrate resilience. We've built a platform that can adapt to regulatory changes faster than traditional players can respond to market disruption.

Our mission hasn't changed: Make essential medications accessible to everyone, not just the wealthy. Novo's termination proves we were succeeding at that mission. Now we're doing it without their permission or their profit sharing demands.

The market will eventually recognize that losing the Novo partnership wasn't a strategic defeat. It was the push we needed to build a truly independent, patient-focused weight management business that no pharmaceutical company can shut down.

Our Growth Strategy: The recovery vision & investment reality check

The next 12 months will determine whether we're a temporary casualty of regulatory tightening or a resilient platform company capable of reinvention. Our strategic vision involves expanding beyond prescription medications into comprehensive health and wellness solutions.

Recovery catalysts include successful diversification across multiple treatment categories, resolution of legal challenges through settlement or favorable rulings, and potential acquisition of complementary health technology companies. We're not just defending our market position; we're building the infrastructure for the next phase of healthcare disruption.

Resource allocation prioritizes legal defense, regulatory compliance, and accelerated growth in non-GLP-1 categories. We're investing in clinical expertise, technology infrastructure, and strategic partnerships that reduce dependence on single pharmaceutical relationships.

The regulatory landscape creates both challenge and opportunity. Increased scrutiny eliminates weaker competitors while established platforms with strong compliance capabilities gain market share. Our experience navigating complex regulatory environments becomes a competitive advantage.

Market timing favors our diversification strategy. Rising healthcare costs increase demand for affordable alternatives across all treatment categories. Consumer comfort with telehealth creates permanent adoption patterns that benefit established platforms.

Current valuation reflects maximum pessimism about our legal and regulatory challenges. The market assumes worst-case scenarios for litigation costs, revenue replacement, and competitive positioning. This creates potential opportunity for investors willing to bet on our platform resilience.

But here's the honest assessment: We're no longer the explosive growth story we were during the GLP-1 boom. We're a mature telehealth platform fighting to maintain market position while defending against legal challenges. The fundamentals remain solid, but the risk profile has fundamentally changed.

This strategic foundation explains why we're still standing despite regulatory headwinds and legal challenges, but successful investing requires understanding both the opportunity and the risks. In this week's "Fundamentals Meet Technicals" analysis, I'll break down whether our current valuation reflects temporary headwinds or permanent impairment, and identify whether this legal uncertainty creates a buying opportunity or a value trap.

If you enjoyed reading this article, and would like to read more articles like this one, you should go and check out the following:

In the coming days, I'll be publishing a comprehensive 'Fundamentals meet Technicals' analysis that dives deep into the company's financial statements while applying technical indicators to determine whether the stock presents a compelling buying opportunity. This dual-lens approach will provide you with both the fundamental backdrop and technical setup needed to make an informed investment decision.

Stay subscribed to ensure you don't miss this in-depth analysis and other valuable investment insights.

Disclaimer: Here