In this article, I’ll walk you through Morningstar’s framework for Wide Moat investing. Over the years, stocks classified as Wide Moat by Morningstar have consistently outperformed the market by a significant margin.

Morningstar evaluates companies based on their Economic Moat, or competitive advantage, and categorizes them into three groups:

Wide Moat – Strong, sustainable competitive advantages.

Narrow Moat – Some advantages, but less durable.

No Moat – Little to no lasting competitive edge.

Our focus? Wide Moat businesses—companies with deep competitive advantages that can maintain strong profitability over the long run. Let’s dive in.

Overview

Today, I’ll cover the following:

What is an Economic Moat

Return on Invested Capital

Why are Wide Moat Businesses so Strong

Wide-Moat Stocks Performance

Five Moat Types

If you like reading about Wide-Moat Stocks. You should definitely SUBSCRIBE to never miss any posts!

What is an Economic Moat

Morningstar defines an economic moat as a structural advantage that enables a company to generate excess economic returns over a long period. In simpler terms, a company with a strong moat consistently earns more on its invested capital than it costs to finance that capital.

The key metric? Return on Invested Capital (ROIC) > Weighted Average Cost of Capital (WACC).

A Wide Moat stock is one that can sustain this profitability advantage, making it a strong long-term investment.

Return on Invested Capital (ROIC)

ROIC is a crucial metric for assessing whether a company has a Wide Moat. It measures how efficiently a company generates returns on the capital it invests. In essence, a consistently high ROIC compared to its cost of capital (WACC) is a strong indicator of a durable competitive advantage.

Why are Wide Moat Businesses so Strong

To answer that, you need to ask yourself: Do I achieve better returns by investing in Wide Moat Businesses?

Let me provide the answer. Over the last 10 years, the Morningstar Wide Moat Index delivered an annual return of 13.60% to shareholders, compared to 12.98% for the S&P 500.

Wide-Moat Stocks Performance

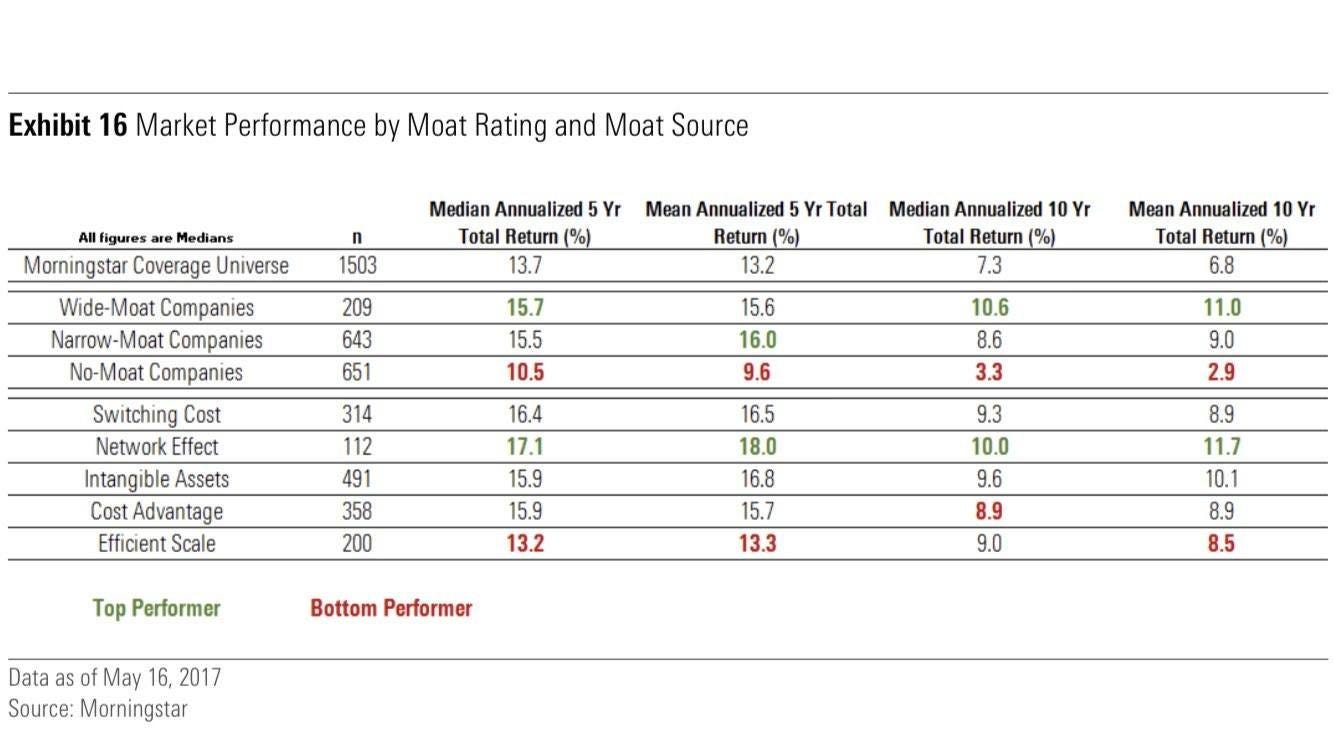

Over a period of 5 and 10 years, Wide-Moat stocks based on Network Effects seemed to report the Best Performance. Cost advantages and Efficient Scale are the least preferred Moat sources.

If we look at Morningstar’s Research, we can see that the Median Annualized 10-Year Total Return is:

+10.6% for WIDE moat companies

+8.6% for NARROW moat companies

+3.3% for NO moat companies

Five Moat Types

Morningstar states that there are 5 moat types:

Intangible Assets

Switching Costs

Cost Advantage

Eficient Scale

Network Effects

1. Intangible Assets

Intangible assets like brands, patents, and regulatory licenses can create a strong competitive advantage, making it difficult for competitors to replicate a company’s success. These assets help protect market share and profitability over the long term.

Take Coca-Cola, for example. Its brand is so powerful that even with unlimited resources, dethroning it would be nearly impossible:

“If you gave me $100 billion and said take away the soft drink leadership of Coca-Cola in the world, I'd give it back to you and say it can't be done.” – Warren Buffett

2. Switching Costs

Switching costs are the barriers—financial, time-related, or effort-based—that make it difficult for customers to move from one product or service to another. These costs help companies retain customers and maintain long-term profitability by discouraging them from switching to competitors.

3. Cost Advantage

When a company can consistently operate at lower costs than its competitors.

4. Efficient Scale

Efficient scale occurs when a company operates in a market with limited competition due to natural constraints, such as high infrastructure costs, niche demand, or regulatory barriers. In such markets, the presence of too many competitors would reduce profitability for all, discouraging new entrants and allowing established players to maintain dominance.

5. Network Effects

The fifth and last layer of the moat is Network Effects. This occurs when the value of a product or service increases as more people use it, creating a self-reinforcing cycle. As more users join, the product becomes more valuable, attracting even more users. This strengthens a company's position by making it harder for competitors to replicate the same value. For example, platforms like Facebook or Uber become more useful as more users join. Network effects create a strong barrier to entry, offering long-term competitive advantage and customer loyalty.

Want to dive deeper into Wide Moat Businesses? Check out this article, you won’t want to miss it!

Enjoyed this article? Subscribe now to stay updated and never miss a post!

Disclaimer:

The content of this analysis is for informational purposes only and should not be considered financial or investment advice. The opinions expressed are my own and based on publicly available information at the time of writing. Before making any investment decisions, please conduct your own research or consult with a professional financial advisor to assess your individual situation. Investing in the stock market involves risk, and past performance is not indicative of future results.