For years, Uber has dominated ride-hailing, leveraging scale and network effects. But with autonomous vehicles (AVs) on the horizon, many have questioned whether its dominance is at risk.

Some point to Tesla as a major threat, given Elon Musk’s bold claims about a future RoboTaxi network. But in reality, Tesla has yet to deploy a single fully autonomous ride-hailing service. Despite its advancements in driver assistance technology, Tesla does not currently pose a direct competitive threat to Uber in this space.

The real challenge comes from players like Waymo. Unlike Tesla, Waymo already operates fully autonomous ride-hailing services in select cities. With Alphabet’s financial backing and years of AV development, it has positioned itself as a legitimate competitor in driverless mobility.

So, is Uber’s moat at risk? Not from Tesla—at least not yet. But the landscape is shifting, and other competitors could redefine the industry. In this deep dive, we’ll explore the true risks and what Uber must do to stay ahead.

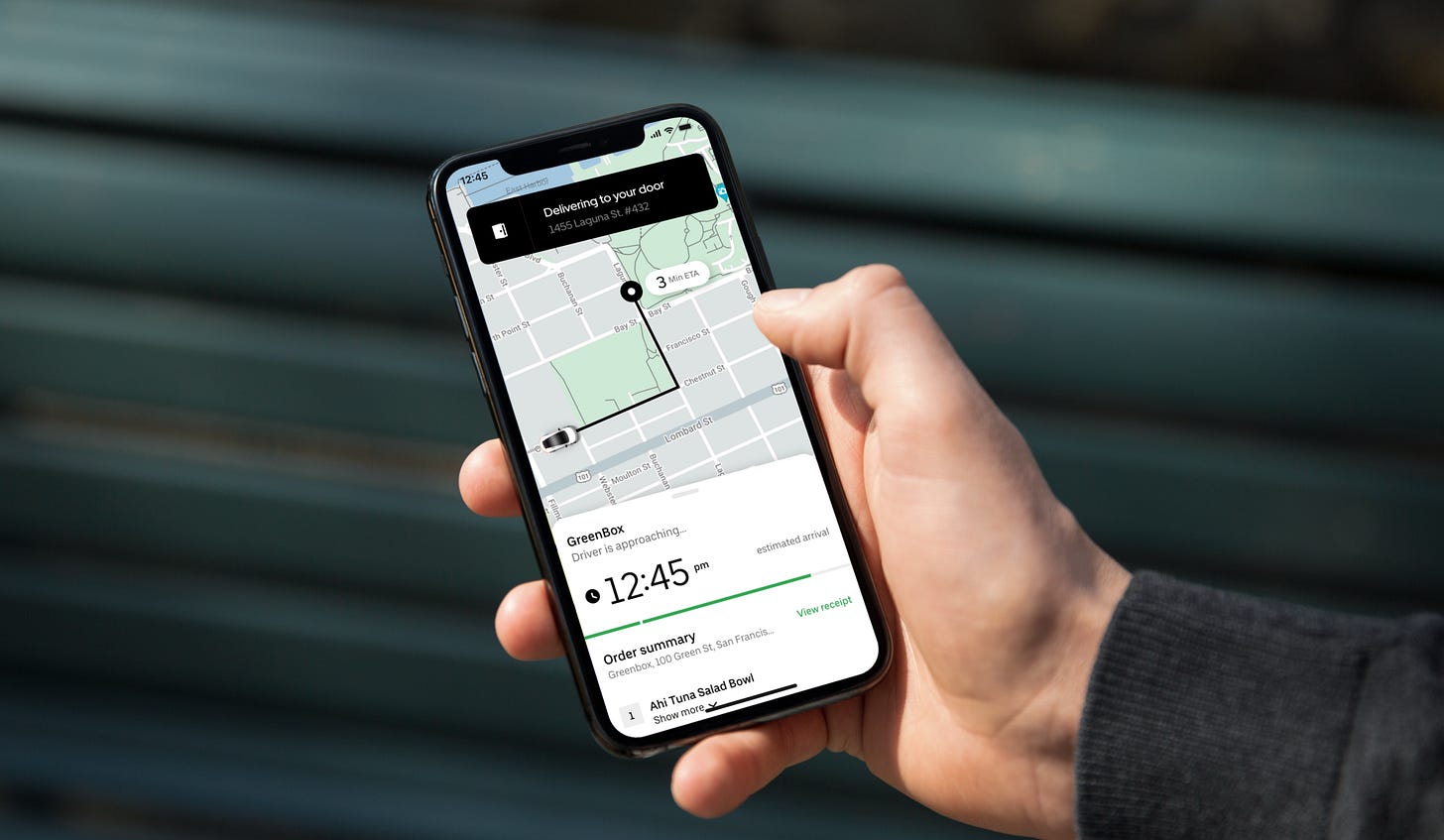

If you're already familiar with Uber’s moat, feel free to skip this part. But if not, I recommend checking out my Substack post where I break it down in detail:

If you like what you are reading and like reading more Deep Dives on quality companies then I suggest you subscribe to my Substack. The Autonomous Vehicle Landscape: A Changing Industry

As the technology behind autonomous vehicles improves, ride-hailing giants like Uber are facing increasing competition from companies that are developing fully autonomous transportation solutions. While traditional ride-hailing relies on a massive fleet of human drivers, AVs have the potential to dramatically reduce operational costs and change the way transportation services are delivered. The development of autonomous vehicles presents both challenges and opportunities for Uber.

Tesla: The Strong Competitor with Vertical Integration

One of the most discussed threats to Uber's future is Tesla. Under the leadership of Elon Musk, Tesla has made aggressive strides in developing autonomous vehicle technology. Tesla's approach differs from Uber's, in that it combines hardware (electric vehicles) and software (autonomous driving technology) within a single, vertically integrated company. This is also something that many retail investors view as a highly valuable asset for Tesla in the near future, when they will be able to deploy this technology and expand their ride-hailing business.

Autopilot and Full Self-Driving (FSD) Technology

Tesla's Autopilot system, currently available in millions of cars, offers semi-autonomous driving capabilities. Additionally, Tesla's Full Self-Driving (FSD) package aims to eventually provide a fully autonomous driving experience. Though the system is still in the testing phase, it represents a major potential challenge to Uber. Unlike Uber, Tesla's fleet already exists, which positions the company to offer a RoboTaxi network—where owners of Tesla vehicles can share their cars via an app for autonomous rides.

This model directly competes with Uber's business model by eliminating the need for external human drivers. If Tesla successfully scales its RoboTaxi network, it could present a major competitive threat to Uber, especially in terms of cost efficiency and scalability. Tesla's ability to update its software over the air also accelerates improvements to its AV technology, putting it ahead of Uber's development in this field.

The question I’m raising here as an Uber investor is: Will the deployment of this technology be as easy as it seems? And if executed well, could a partnership between Uber and Tesla be more beneficial for both companies in the long run, rather than fighting for dominance, why not share the opportunity instead?

On one hand, if both companies decide to remain rivals, they would be battling for control over the autonomous ride-hailing space, each vying for market share, resources, and customer loyalty. This could lead to intense competition and potentially costly investments as they attempt to outpace each other in developing autonomous technology, scaling fleets, and securing regulatory approvals. While Uber has its stronghold in the market with its existing ride-hailing infrastructure, Tesla’s technological prowess and brand recognition could give it a significant advantage over time.

On the other hand, a partnership between the two could prove to be a more strategic move. By combining Uber’s global network of riders and drivers with Tesla’s advanced autonomous driving technology, both companies could benefit from a faster and more cost-efficient deployment of self-driving vehicles. Uber could tap into Tesla’s innovation, while Tesla could leverage Uber’s established platform and customer base, potentially reducing the risks and uncertainties of competing against each other. Such a collaboration could help both companies stay ahead in a rapidly evolving market, where the pace of technological advancements and regulatory challenges could make it difficult to predict the future.

In this scenario, instead of fighting for the bone, they would be working together to strengthen their positions, ensuring they both secure a piece of the lucrative autonomous vehicle market.

Additionally, it's worth noting that we already see many Teslas being used by Uber drivers today. As part of Uber's efforts to electrify its fleet, Tesla vehicles are increasingly popular among drivers, especially for those looking to reduce fuel costs and take advantage of the environmental benefits. The integration of Tesla’s vehicles into Uber’s platform is already happening, and it could be the first step toward a closer collaboration in the future, one where the companies come together to drive forward the autonomous vehicle revolution.

Cost Structure and Profitability

Tesla’s vertical integration gives it a significant advantage in reducing operational costs. By controlling both the production of vehicles and the development of autonomous software, Tesla can bypass many of the overhead costs that Uber faces with its driver-partner model. Additionally, Tesla’s electric vehicle (EV) infrastructure, including charging stations, further lowers maintenance and fuel costs, making its autonomous ride-hailing services potentially far more profitable than Uber’s human-driven alternatives.

Expansion and Market Reach

Tesla’s presence in global markets such as the United States, Europe, and China provides it with a broad customer base, allowing it to deploy autonomous vehicles more quickly. By leveraging its existing fleet, Tesla could outpace Uber in the deployment of autonomous ride-hailing services, particularly in key urban areas. This global reach, combined with Tesla's brand recognition, positions the company as a formidable competitor for Uber in the coming years.

Waymo: Alphabet’s Autonomous Vehicle Arm

While Tesla is often seen as a competitor in the autonomous vehicle space, it is Waymo—a subsidiary of Alphabet (Google’s parent company)—that has already deployed fully autonomous ride-hailing services in select cities.

Waymo's Advanced Technology

Waymo has made significant strides in developing fully autonomous vehicles, and its cars already operate with Level 4 autonomy in defined geographic areas. This level of autonomy means that Waymo’s vehicles can function without human drivers within a set environment—something Uber is still working toward with its Level 3 autonomous vehicles.

Waymo uses a mix of advanced sensors, including LiDAR, radar, and cameras, which enables its cars to navigate complex urban environments. In comparison, Tesla relies primarily on cameras and neural networks, which may be more limited in certain situations. Waymo’s technology offers the potential for more reliable and efficient operations in environments where Tesla’s camera-based system might struggle.

Waymo One: A Direct Competitor to Uber

Waymo has already launched its commercial autonomous taxi service, Waymo One, in Phoenix, Arizona. This service provides a fully autonomous alternative to Uber’s ride-hailing business, and Waymo is actively working to expand its coverage to additional cities. Unlike Uber, which relies on human drivers, Waymo’s operations are driverless, offering a significant cost advantage.

Waymo’s business model is designed for scalability. By removing the need for human drivers, Waymo eliminates a major cost component that Uber cannot yet replicate with its hybrid human and autonomous fleet. As Waymo continues to expand its services, it presents a direct challenge to Uber’s market share, particularly in urban environments where autonomous vehicles could be more efficient.

Alphabet's Financial Backing and Long-Term Vision

As a subsidiary of Alphabet, Waymo benefits from substantial financial backing. Alphabet’s resources allow Waymo to invest heavily in research and development, regulatory compliance, and large-scale deployment of autonomous vehicles. Waymo’s long-term vision includes achieving Level 5 autonomy, which would allow its vehicles to operate without human intervention in any environment, further reducing operational costs and improving profitability.

With Alphabet’s support, Waymo is well-positioned to outpace Uber in the race for fully autonomous vehicles. While Uber faces significant hurdles in scaling its autonomous fleet, Waymo’s reliance on established automotive manufacturers like Chrysler and Jaguar Land Rover to integrate its technology into their vehicles positions it for faster growth and easier scalability.

The Hybrid Model of Disruption: Waymo vs. Tesla

Both Tesla and Waymo present unique challenges to Uber’s business model. Tesla’s vertically integrated approach, combined with its existing fleet of vehicles and over-the-air software updates, positions it to scale its autonomous services quickly. If Tesla succeeds in rolling out a RoboTaxi network, Uber could find itself competing with a company that already has a customer base, a fleet of vehicles, and a deep technological advantage.

On the other hand, Waymo’s focus on safety, regulatory compliance, and partnerships with traditional automakers gives it a unique edge in terms of scalability. Waymo’s autonomous vehicles already operate in commercial settings, while Uber’s autonomous efforts are still in the testing phase. As Waymo continues to expand, it may find itself in direct competition with Uber, particularly as both companies strive to dominate the autonomous ride-hailing market.

Uber’s Path Forward: What It Needs to Do

To maintain its leadership in the ride-hailing space, Uber will need to adapt to the shifting landscape of autonomous vehicles. While Tesla and Waymo are formidable competitors, Uber still has several advantages that it can leverage, including its vast customer base, established brand, and expertise in managing complex logistics.

Focus on Strategic Partnerships

Uber has already begun investing in its own autonomous vehicle program, but to remain competitive, it will need to form strategic partnerships with automakers, technology companies, and regulatory bodies. By collaborating with established players in the autonomous vehicle space, Uber can accelerate its own technological development and mitigate the risks associated with deploying AVs at scale.

Scale and Market Penetration

Uber’s scale is one of its greatest strengths. To compete effectively with Tesla and Waymo, Uber must continue to leverage its network effects and expand its reach in key urban markets. By maintaining a strong foothold in cities around the world, Uber can retain its dominance in the ride-hailing space while simultaneously investing in autonomous vehicle technology.

Regulatory Navigation and Safety

As autonomous vehicles become more mainstream, regulatory approval will be crucial for Uber’s success. To stay ahead of competitors, Uber will need to prioritize safety and compliance with local regulations. By working closely with governments and regulators, Uber can ensure that its autonomous vehicles are deployed safely and efficiently.

Conclusion: The Autonomous Future is Now

Uber’s future in the ride-hailing market is at a critical juncture. While the company has established itself as a leader in the industry, the rise of autonomous vehicles presents both challenges and opportunities. Tesla’s vertical integration and potential RoboTaxi network, combined with Waymo’s focus on scalability, create significant competitive threats. However, Uber’s scale, brand recognition, and investments in autonomous technology position it to remain a major player in the market for years to come.

To stay ahead, Uber must adapt quickly, forming strategic partnerships and scaling its autonomous vehicle fleet. The next few years will be crucial in determining whether Uber can maintain its dominance or whether new entrants, like Tesla and Waymo, will redefine the future of ride-hailing. The competition in autonomous vehicles is just beginning, and Uber’s ability to navigate these challenges will determine its place in the future of transportation. It won’t be easy for Tesla and Waymo to simply push Uber out of the AV market.

If you enjoyed this analysis on the AV competition and Uber's position in the market, there's much more to come. The world of strong quality businesses is constantly evolving, and staying informed is key to making the best investment decisions.

Be sure to subscribe to my Substack for even more in-depth analysis on businesses that are shaping the future. My next piece will focus on Block and its potential in the financial ecosystem. Don’t miss out on insightful, actionable content—subscribe now and stay ahead of the curve!

Enjoyed this! Tesla’s a future risk, Waymo’s a current one, but Uber’s scale holds strong for now. A Tesla partnership could be a game-change.