4 Financial Stocks that are (potential) BUYS

A Simple Growth Analysis on Four Financial Conglomerates.

In this article, I’ll talk about Four Financial Stocks:

Visa

Mastercard

S&P Global

Moody’s Corporation

It’s not gonna be a long article but just a simple, easy to understand one.

I’ll discuss the following things on the stocks above:

Forward P/E (to get an understanding of how cheapily priced the stock are currently)

Reverse DCF model (to take into account how much they need to grow their FCF in the future for me to get an annual return of 10%)

Visa

Let’s start of with the first stock — Visa.

Forward P/E

Currently, Visa’s Forward P/E is the following:

Under my own framework, I would argue that this means that Visa is currently undervalued. Because it’s trading under it’s historical (5year) median.

Reverse DCF

Let’s look into a Reverse DCF for Visa.

The current Stock Price as of the 9th of April is:

$308.27

The Number of Shares outstanding are:

2 000 million

The Free Cash Flow in Year 1

$22.556 million (expected FCF for 2025)

Two adjustments need to be made to Visa’s FCF:

Subtract Stock-Based Compensation (cost for shareholders)

Add Growth CAPEX

SBC = $865 million

Growth Capex = $1.335 million - $990 million = $345 million

Adjusted FCF = $22.556 million - $865 million + $345 million = $22.036 million

Growth rate = 13.36% (This number shows you how much Visa’s FCF should grow in the next 10 years to generate a return of 10% per year for you as a shareholder.)

Visa needs to grow its FCF by 13.36% per year to generate an annualised return of 10%.

Is this realistic?

Let’s look at two things:

The historical FCF Growth of Visa

Analysts’ expectations

Historical FCF Growth

Visa’s Historical FCF CAGR over the last 5 years has been 13.78%.

Analysts’ expectations

Analyst expect Visa to grow its FCF by 12% per year.

Is Visa overvalued or undervalued?

Now, let’s determine whether Visa is overvalued or undervalued.

Expectations implied in the current stock price (Reverse DCF): 13.36%

→ Visa should grow its FCF by 13.36% per year to generate a return of 10% per year for you as an investor.

Is this realistic?

→ Visa has grown its FCF by 13.78% per year over the past 5 years

→ Analysts expect Visa to grow its FCF by 12% per year in the years ahead.

Taking everything in account, and basing myself on the following numbers, I think we can imply that at the current price (today) Visa is Fairly Valued.

Mastercard

The second stock is — Mastercard.

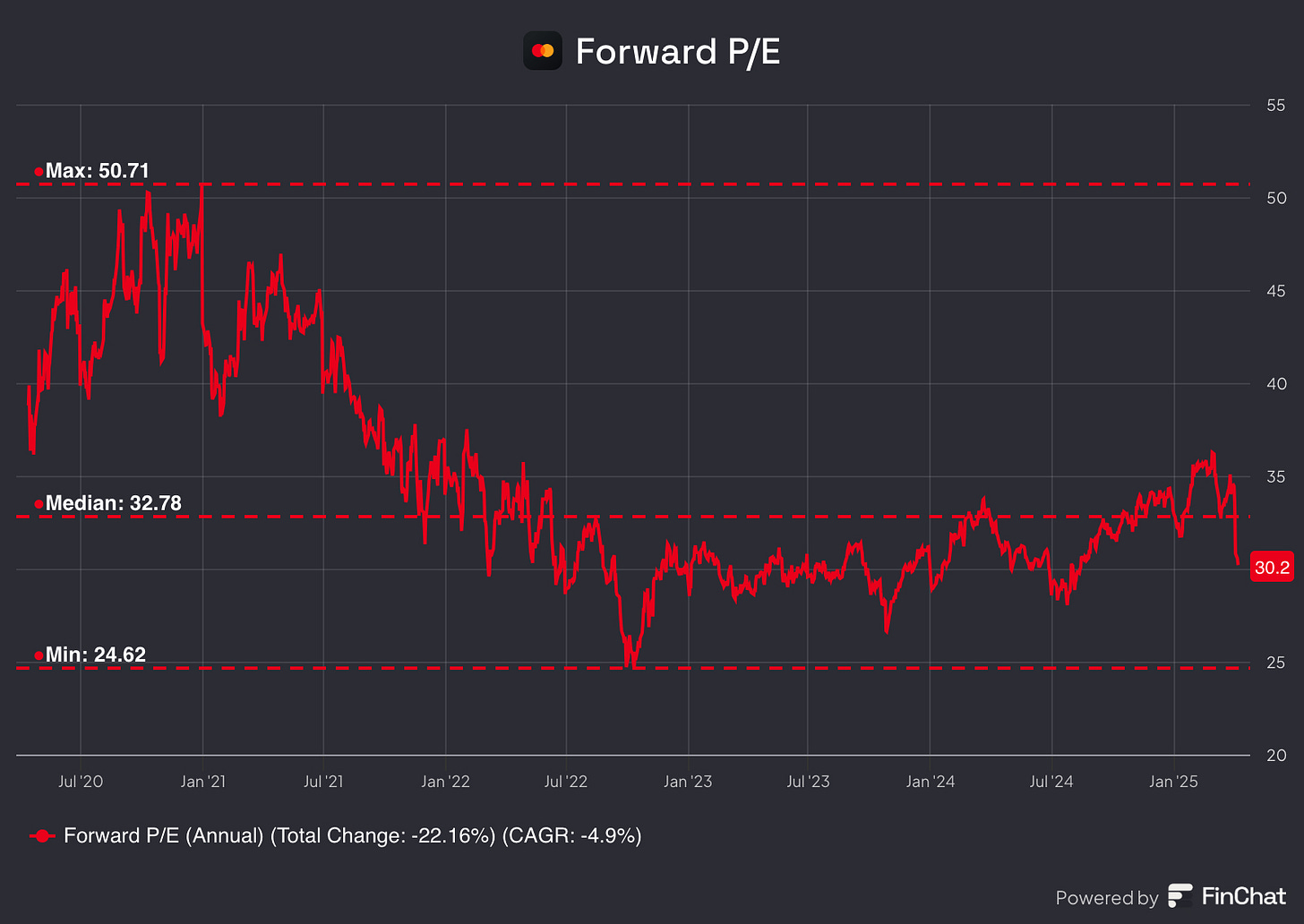

Forward P/E

Currently, Mastercard’s Forward P/E is the following:

Based on my own framework, I’d argue that Mastercard is currently undervalued. Because of the fact that it’s trading under it’s historical (5year) median.

Reverse DCF

Let’s look into a Reverse DCF for Mastercard.

The current Stock Price as of the 9th of April is:

$479.92

The Number of Shares outstanding are:

914 million

The Free Cash Flow in Year 1

$14.906 million (expected FCF for 2025)

Two adjustments need to be made to Mastercard’s FCF:

Subtract Stock-Based Compensation (cost for shareholders)

Add Growth CAPEX

SBC = $526 million

Growth Capex = $474 million - $519 million = -$45 million

Adjusted FCF = $14.906 million - $526 million - $45 million = $14.335 million

Growth rate = 14.73% (This number shows you how much Mastercard’s FCF should grow in the next 10 years to generate a return of 10% per year for you as a shareholder.)

Mastercard needs to grow its FCF by 14.73% per year to generate an annualised return of 10%.

Is this realistic?

Let’s look at two things:

The historical FCF Growth of Mastercard

Analysts’ expectations

Historical FCF Growth

Mastercard’s Historical FCF CAGR over the last 5 years has been 15.44%.

Analysts’ expectations

Analyst expect Mastercard to grow its FCF by 14.6% per year.

Is Mastercard overvalued or undervalued?

Now, let’s determine whether Mastercard is overvalued or undervalued.

Expectations implied in the current stock price (Reverse DCF): 14.73%

→ Mastercard should grow its FCF by 14.73% per year to generate a return of 10% per year for you as an investor.

Is this realistic?

→ Mastercard has grown its FCF by 15.44% per year over the past 5 years

→ Analysts expect Mastercard to grow its FCF by 14.6% per year in the years ahead.

Taking everything in account, and basing myself on the following numbers, I think we can imply that at the current price (today) Mastercard is Fairly Valued.

S&P Global

The third stock is — S&P Global.

Forward P/E

Currently, S&P’s Forward P/E is the following:

Based on my own framework, I’d argue that S&P Global is currently undervalued. Because of the fact that it’s trading under it’s historical (5year) median.

Reverse DCF

Let’s look into a Reverse DCF for S&P Global.

The current Stock Price as of the 9th of April is:

$441.50

The Number of Shares outstanding are:

308 million

The Free Cash Flow in Year 1

$5.643 million (expected FCF for 2025)

Two adjustments need to be made to S&P Global’s FCF:

Subtract Stock-Based Compensation (cost for shareholders)

Add Growth CAPEX

SBC = $247 million

Growth Capex = $124 million - $96 million = $28 million

Adjusted FCF = $5.643 million - $247 million + $28 million = $5.424 million

Growth rate = 11.68% (This number shows you how much S&P Global’s FCF should grow in the next 10 years to generate a return of 10% per year for you as a shareholder.)

S&P Global needs to grow its FCF by 11.68% per year to generate an annualised return of 10%.

Is this realistic?

Let’s look at two things:

The historical FCF Growth of S&P Global

Analysts’ expectations

Historical FCF Growth

S&P Global’s Historical FCF CAGR over the last 5 years has been 12.36%.

Analysts’ expectations

Analyst expect S&P Global to grow its FCF by 15.3% per year.

Is S&P Global overvalued or undervalued?

Now, let’s determine whether S&P Global is overvalued or undervalued.

Expectations implied in the current stock price (Reverse DCF): 11.68%

→ S&P Global should grow its FCF by 11.68% per year to generate a return of 10% per year for you as an investor.

Is this realistic?

→ S&P Global has grown its FCF by 12.36% per year over the past 5 years

→ Analysts expect S&P Global to grow its FCF by 15.3% per year in the years ahead.

Taking everything in account, and basing myself on the following numbers, I think we can imply that at the current price (today) S&P Global is slightly Undervalued.

Moody's Corporation

The last stock is — Moody’s.

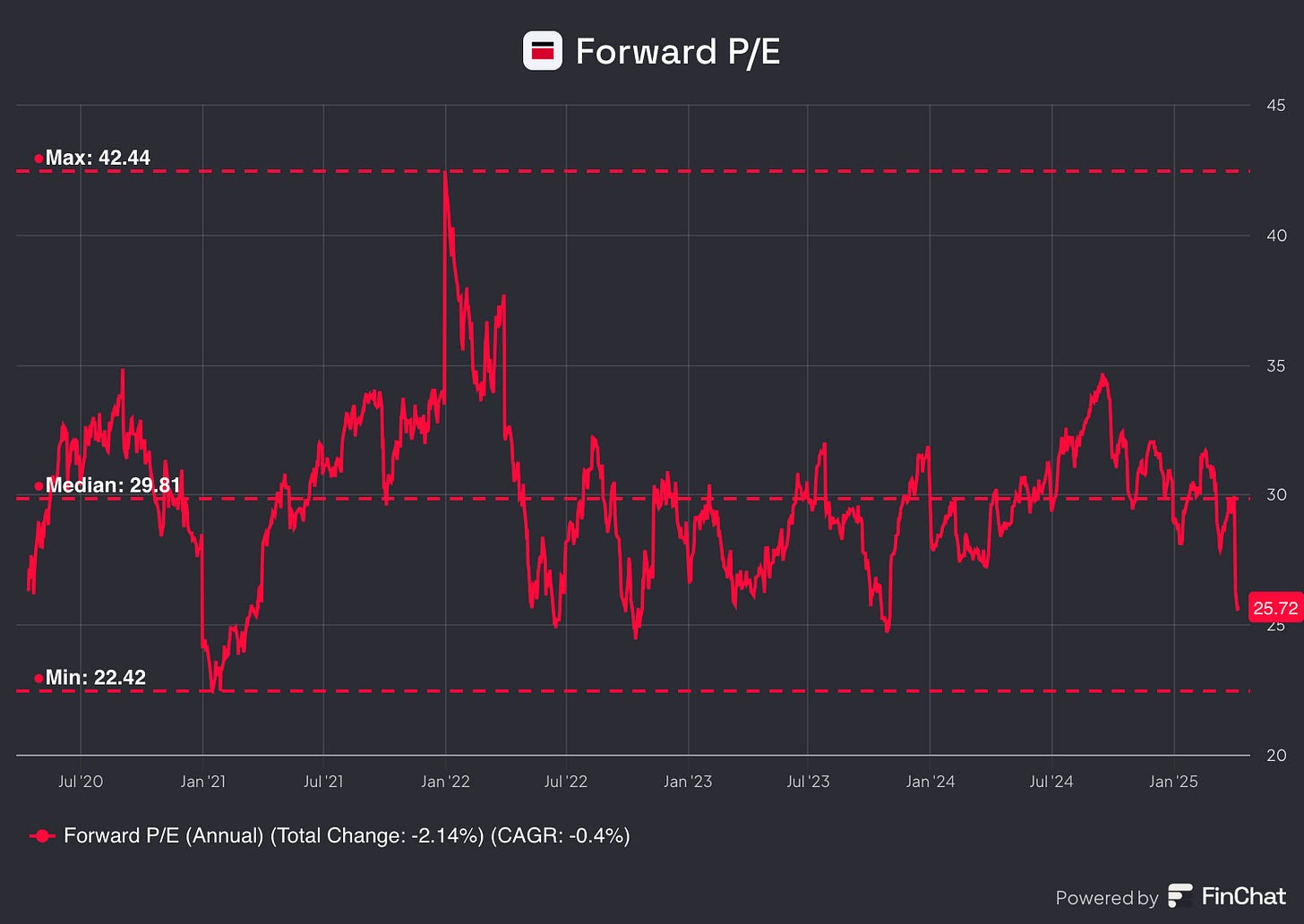

Forward P/E

Currently, Moody’s Forward P/E is the following:

Based on my own framework, I’d argue that Moody’s is currently undervalued. Because of the fact that it’s trading under it’s historical (5year) median.

Reverse DCF

Let’s look into a Reverse DCF for Moody’s.

The current Stock Price as of the 9th of April is:

$396.70

The Number of Shares outstanding are:

180 million

The Free Cash Flow in Year 1

$2.523 million (expected FCF for 2025)

Two adjustments need to be made to Moody’s FCF:

Subtract Stock-Based Compensation (cost for shareholders)

Add Growth CAPEX

SBC = $220 million

Growth Capex = $317 million - $53 million = $264 million

Adjusted FCF = $2.523 million - $220 million + $264 million = $2.039 million

Growth rate = 16.79% (This number shows you how much Moody’s FCF should grow in the next 10 years to generate a return of 10% per year for you as a shareholder.)

Moody’s needs to grow its FCF by 16.79% per year to generate an annualised return of 10%.

Is this realistic?

Let’s look at two things:

The historical FCF Growth of Moody’s

Analysts’ expectations

Historical FCF Growth

Moody’s Historical FCF CAGR over the last 5 years has been 9.54%.

Analysts’ expectations

Analyst expect Moody’s to grow its FCF by 18.5% per year.

Is Moody’s overvalued or undervalued?

Now, let’s determine whether Moody’s is overvalued or undervalued.

Expectations implied in the current stock price (Reverse DCF): 16.79%

→ Moody’s should grow its FCF by 16.79% per year to generate a return of 10% per year for you as an investor.

Is this realistic?

→ Moody’s has grown its FCF by 9.54% per year over the past 5 years

→ Analysts expect Moody’s to grow its FCF by 18.5% per year in the years ahead.

Taking everything in account, and basing myself on the following numbers, I think we can imply that at the current price (today) Moody’s is slightly Overvalued.

Conclusion

Based on the current metrics, it looks like S&P Global is the only stock of the four that appears to be Undervalued. The rest seem fairly valued or slightly overvalued at this point.

That said, it’s crucial to take the full picture into account. Attractive numbers alone aren't enough, you still need to do your own due diligence and dive deep into each business individually to really understand what you're investing in.

Also keep in mind: this is just a snapshot in time. What looks undervalued today might not be tomorrow.

If you liked reading this piece, make sure to SUBSCRIBE to never miss any posts!

If you found this valuable, give it a share so others can benefit too.

Curious to hear what you think of how I structured this piece. Open to any feedback!

Disclaimer:

The content of this analysis is for informational purposes only and should not be considered financial or investment advice. The opinions expressed are my own and based on publicly available information at the time of writing. Before making any investment decisions, please conduct your own research or consult with a professional financial advisor to assess your individual situation. Investing in the stock market involves risk, and past performance is not indicative of future results.

Nice and simple. S&P Global is looking pretty good 🤔